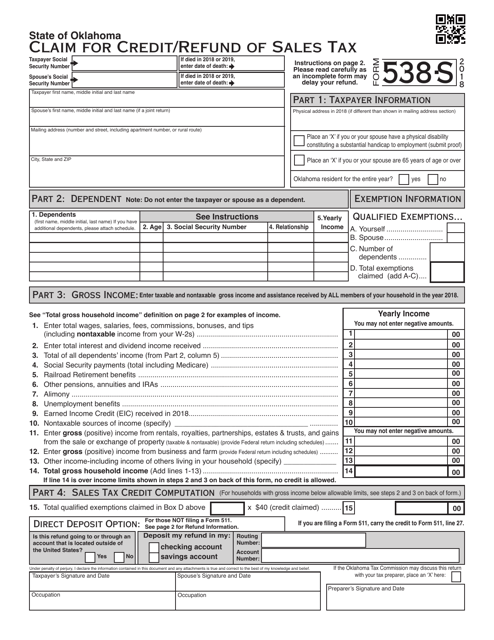

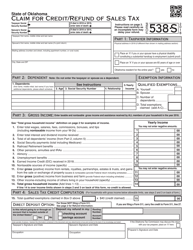

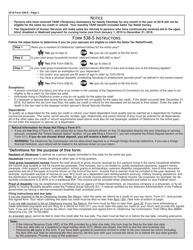

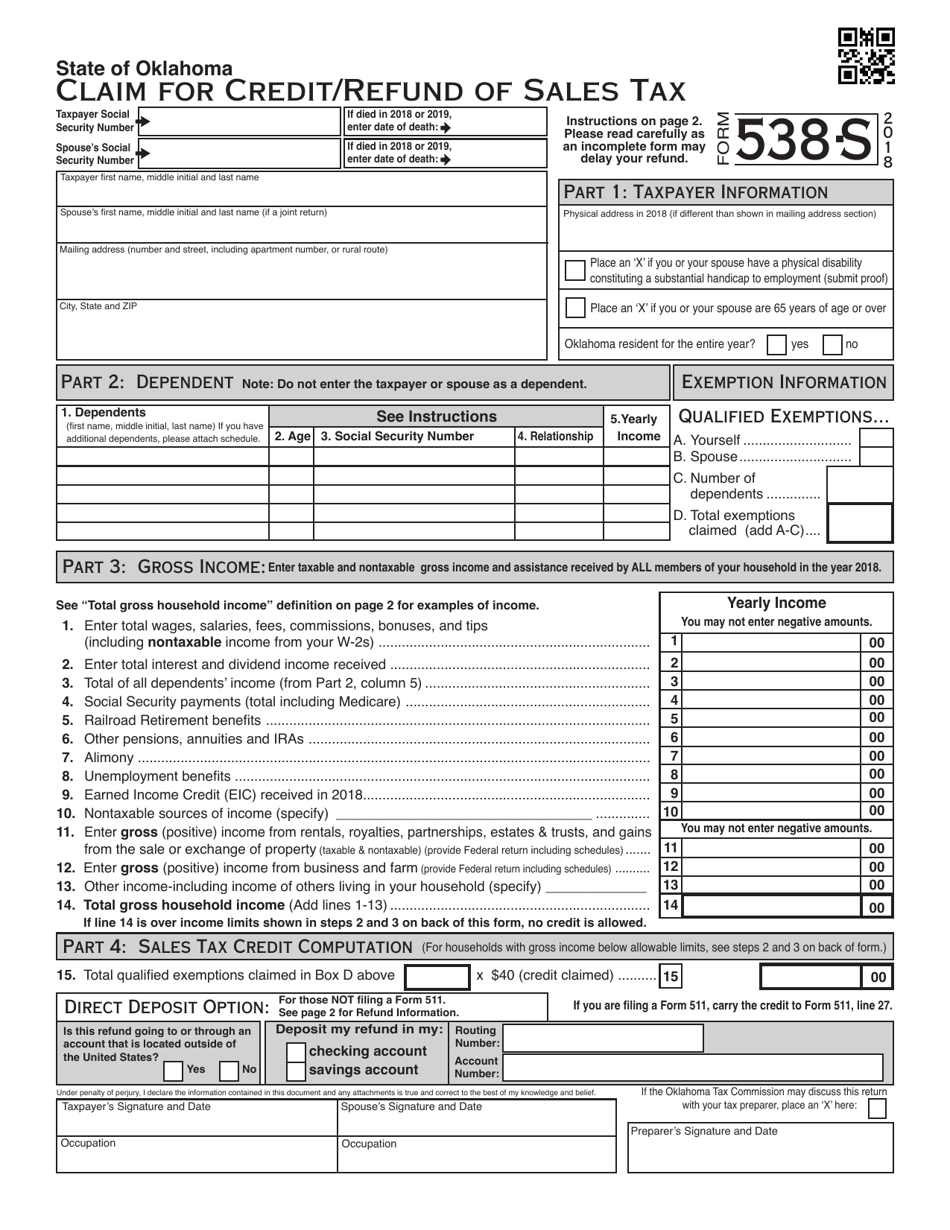

OTC Form 538-S Claim for Credit / Refund of Sales Tax - Oklahoma

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 538-S?

A: OTC Form 538-S is the Claim for Credit/Refund of Sales Tax specific to Oklahoma.

Q: Who can file OTC Form 538-S?

A: Individuals or businesses who overpaid sales tax in Oklahoma can file OTC Form 538-S.

Q: What is the purpose of OTC Form 538-S?

A: The purpose of OTC Form 538-S is to claim a credit or refund for sales tax overpayment in Oklahoma.

Q: What information is required on OTC Form 538-S?

A: Information such as the taxpayer's contact details, account number, period of overpayment, and reason for refund is required on OTC Form 538-S.

Q: Can I file OTC Form 538-S electronically?

A: No, OTC Form 538-S cannot be filed electronically. It must be filed either by mail or in person.

Q: What is the deadline for filing OTC Form 538-S?

A: The OTC Form 538-S should be filed within three years from the date of overpayment.

Q: How long does it take to receive a refund after filing OTC Form 538-S?

A: The processing time for refunds after filing OTC Form 538-S can vary, but it typically takes several weeks to several months.

ADVERTISEMENT

Form Details:

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 538-S by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.

Download OTC Form 538-S Claim for Credit / Refund of Sales Tax - Oklahoma

4.5 of 5 ( 12 votes )

1

2

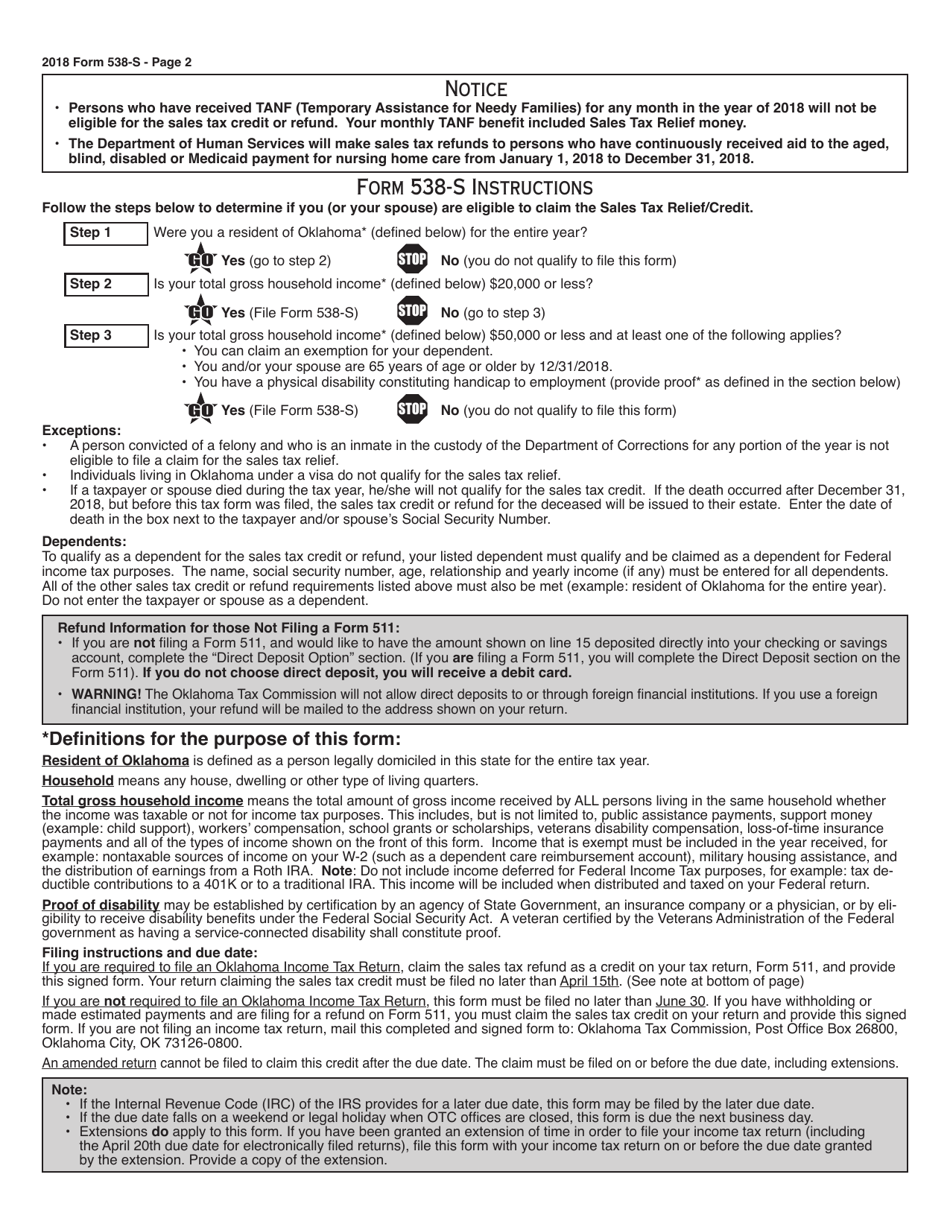

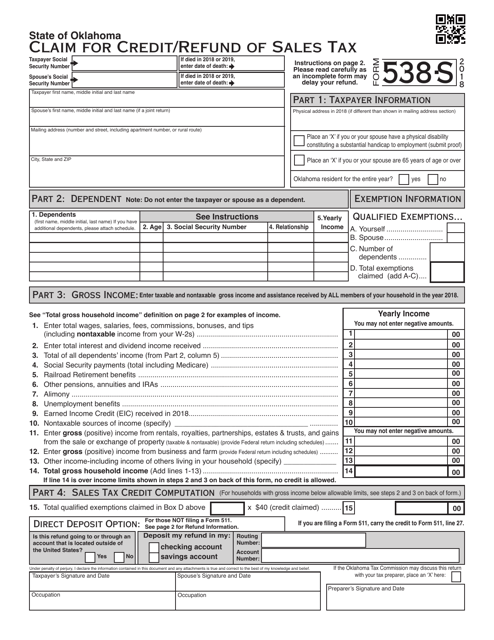

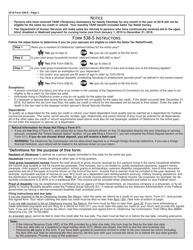

Claim for Credit / Refund of Sales Tax - Oklahoma, Page 1" width="950" height="1230" />

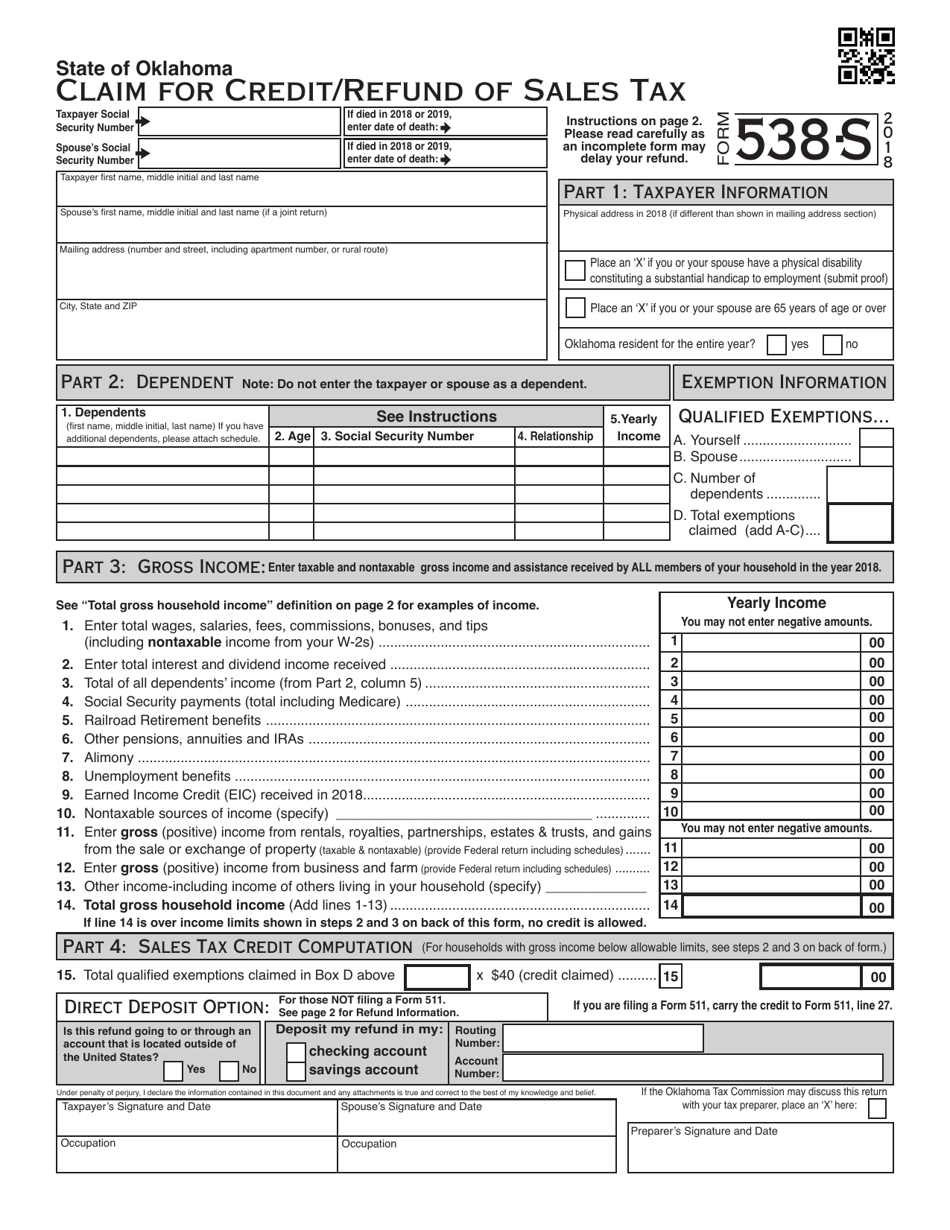

Claim for Credit / Refund of Sales Tax - Oklahoma, Page 1" width="950" height="1230" /> Claim for Credit / Refund of Sales Tax - Oklahoma, Page 2" />

Claim for Credit / Refund of Sales Tax - Oklahoma, Page 2" />

Prev 1 2 Next

ADVERTISEMENT

Linked Topics

Claim for Refund Sales Tax Oklahoma Tax Commission Oklahoma Legal Forms United States Legal Forms

Related Documents

- Form 538-S Claim for Credit/Refund of Sales Tax - Oklahoma, 2023

- OTC Form 538-H Claim for Credit or Refund of Property Tax - Oklahoma, 2018

- OTC Form STS20021 Oklahoma Sales Tax Return 'supplement' - Oklahoma

- OTC Form 505 Injured Spouse Claim and Allocation - Oklahoma

- OTC Form STS20002-A Oklahoma Sales Tax Return - Oklahoma

- OTC Form 13-9 Application for Credit or Refund of State and Local Sales or Use Tax - Oklahoma

- OTC Form 701-31 Motor Vehicle Sales Tax Exemption Certificate - Oklahoma

- OTC Form 13-9-D Application for Credit or Refund of Franchise Tax - Oklahoma

- OTC Form 13-9-C Application for Credit or Refund of Withholding or Pass-Through Withholding Tax - Oklahoma

- OTC Form 13-9-A Application for Refund of State Sales Tax - Oklahoma

- OTC Form 507 Statement of Person Claiming Refund Due a Deceased Taxpayer - Oklahoma

- OTC Form 13-98 Application for Subscription List of Sales Tax Permit Holders - Oklahoma

- OTC Form STS20151 Oklahoma Oil and Gas Operators Casual Sales Tax Return 'supplement' - Oklahoma

- OTC Form STS20015-A Oklahoma Oil and Gas Operators Casual Sales Tax Return - Oklahoma

- Form 538-H Claim for Credit or Refund of Property Tax - Oklahoma, 2023

- Form 13-9 Application for Credit or Refund of State and Local Sales or Use Tax - Oklahoma

- Form 13-9-A Application for Refund of Sales Tax - Blue Star Mothers of America - Oklahoma

- Packet E - Oklahoma Sales Tax Exemption Packet - Oklahoma

- Form STS20002 Oklahoma Sales Tax Return for Filing Returns Prior to July 1, 2017 - Oklahoma

- Form STS20015 Oklahoma Oil and Gas Operators Casual Sales Tax Return for Filing Returns Prior to July 1, 2017 - Oklahoma

- Convert Word to PDF

- Convert Excel to PDF

- Convert PNG to PDF

- Convert GIF to PDF

- Convert TIFF to PDF

- Convert PowerPoint to PDF

- Convert JPG to PDF

- Convert PDF to JPG

- Convert PDF to PNG

- Convert PDF to GIF

- Convert PDF to TIFF

- Split PDF

- Merge PDF

- Sign PDF

- Compress PDF

- Rearrange PDF Pages

- Make PDF Searchable

- About

- Help

- DMCA

- Privacy Policy

- Terms Of Service

- Contact Us

- All Topics

Legal Disclaimer: The information provided on TemplateRoller.com is for general and educational purposes only and is not a substitute for professional advice. All information is provided in good faith, however, we make no representation or warranty of any kind regarding its accuracy, validity, reliability, or completeness. Consult with the appropriate professionals before taking any legal action. TemplateRoller.com will not be liable for loss or damage of any kind incurred as a result of using the information provided on the site.

TemplateRoller. All rights reserved. 2024 ©

Notice

This website or its third-party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy.

Claim for Credit / Refund of Sales Tax - Oklahoma, Page 1" width="950" height="1230" />

Claim for Credit / Refund of Sales Tax - Oklahoma, Page 1" width="950" height="1230" /> Claim for Credit / Refund of Sales Tax - Oklahoma, Page 2" />

Claim for Credit / Refund of Sales Tax - Oklahoma, Page 2" />